Insurance fraud doesn’t just hurt companies—it costs taxpayers billions every year.

Fraudsters fake injuries, stage accidents, or file inflated claims, draining public resources and government programs like Medicare, Medicaid, and workers’ compensation.

For government agencies, investigating these cases is a huge challenge. The data is overwhelming, fraud schemes are getting more sophisticated, and there’s constant pressure to deliver results quickly.

Old methods aren’t enough anymore. Investigators need smarter tools to detect patterns, flag suspicious activity, and process data faster.

In this article, we’ll look at the top 7 insurance fraud investigation software tools that can help agencies uncover fraud and protect public funds.

For more expert insights, see our article: Top 7 Fraud Investigation Software Trusted by Government Agencies.

1. ScanWriter AI

Fraud investigations demand speed, accuracy, and security—qualities that make ScanWriter AI a top choice for government agencies.

This tool is built to handle the massive amounts of data that come with insurance fraud cases, from medical bills to claim forms and bank statements.

Why Government Agencies Trust ScanWriter AI

Data Stays Secure: Unlike many tools that rely on the cloud, ScanWriter AI is an on-premise solution. Your data stays within your system, ensuring it’s safe and compliant with government security standards.

Saves Time: Investigators can process thousands of documents in minutes. ScanWriter extracts data from unstructured formats like PDFs and organizes it into clean, usable spreadsheets.

Detects Hidden Patterns: With AI-driven anomaly detection, it highlights red flags like duplicate claims, inflated charges, or suspicious payment patterns.

Tracks Connections: Its entity link analysis feature maps relationships between individuals, accounts, and transactions, making it easier to uncover coordinated fraud schemes.

Best Use Cases

Medicare and Medicaid fraud investigations.

Workers’ compensation fraud.

Staged accident claims.

Why It Stands Out

For government agencies handling sensitive data, ScanWriter AI offers unmatched security, speed, and precision—making it a must-have for insurance fraud investigations.

2. Shift Technology

Shift Technology focuses on fraud detection for insurance claims using AI-powered models. It scans claims data to identify suspicious patterns and behaviors, helping agencies prioritize high-risk cases.

Key Features

Predictive analytics to flag potentially fraudulent claims before payouts.

Integration with existing claims management systems.

Automated scoring to assess the likelihood of fraud for each claim.

Best Use Cases

Property and casualty claims fraud.

Identifying unusual injury patterns in personal injury claims.

3. FRISS

FRISS is designed to help agencies and insurers tackle fraud across the entire claims process. It provides real-time fraud scoring for faster decision-making, reducing delays in legitimate claims processing.

Key Features

Focuses on claims, underwriting, and compliance fraud.

Risk assessment based on AI models and historical data.

Real-time alerts for suspicious claims.

Best Use Cases

Auto insurance fraud, including staged accidents.

Property insurance fraud, like inflated repair costs.

4. Symphony AI’s NetReveal

NetReveal excels in uncovering organized fraud networks. It combines data from multiple sources to create a complete picture of fraudulent activity.

Key Features

Link analysis to identify connections between individuals and claims.

Advanced analytics to detect staged accident rings or coordinated fraud schemes.

Scalable for agencies handling large datasets.

Best Use Cases

Organized fraud schemes in auto and health insurance.

Detecting fraud across multiple jurisdictions.

5. NICE Actimize

NICE Actimize is an AI-powered platform that detects fraud in claims, payments, and underwriting. It’s particularly effective for agencies that need real-time fraud detection capabilities.

Key Features

Monitors claims and payment systems for anomalies.

Detects patterns indicative of fraud, like frequent claims from the same group of individuals.

Offers compliance tools for anti-money laundering (AML).

Best Use Cases

Insurance payment fraud.

Cross-industry compliance investigations.

6. SAS Fraud Management

SAS Fraud Management uses AI and machine learning to uncover fraudulent claims in real time. It’s customizable and scalable, making it ideal for government agencies of any size.

Key Features

Advanced analytics to detect anomalies in claims data.

Custom dashboards for monitoring fraud trends.

Integration with existing case management tools.

Best Use Cases

Analyzing historical claim patterns for anomalies.

Coordinating investigations across agencies.

7. Verisk’s CLAIMS Outcome Advisor

Verisk’s CLAIMS Outcome Advisor streamlines claims processing and fraud detection. It provides detailed insights into claims data to identify unusual patterns or red flags.

Key Features

Integrates fraud detection into the claims workflow.

Provides scoring and risk analysis for claims.

Tracks claims history for patterns of abuse.

Best Use Cases

Fraud prevention in auto and workers’ compensation claims.

Monitoring claims for inconsistencies in supporting documentation.

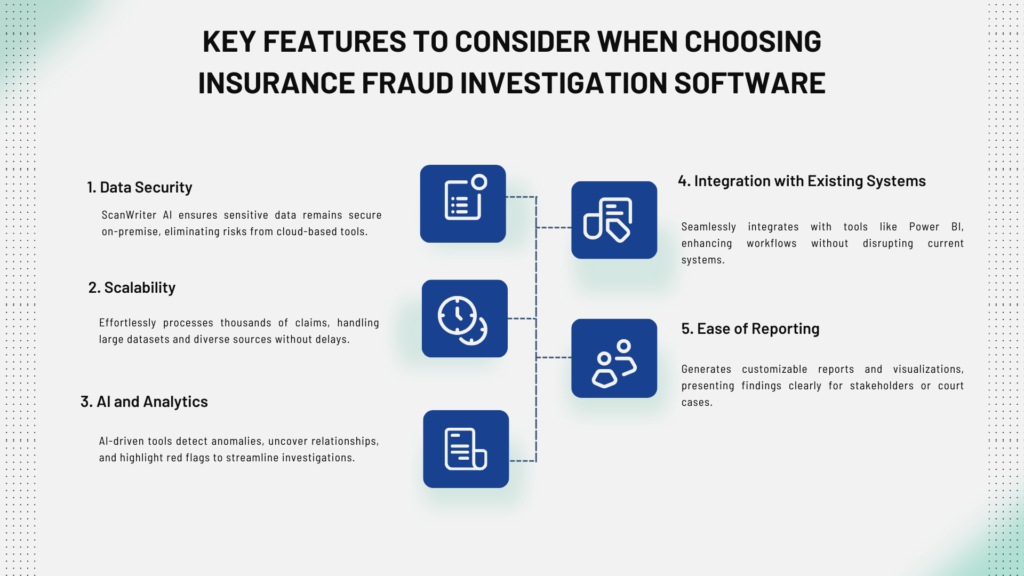

Key Features to Consider When Choosing Insurance Fraud Investigation Software

1. Data Security

Insurance fraud investigations involve sensitive personal and financial data. From medical records to payment histories, ensuring the security of this information is critical.

Many tools rely on cloud storage, which can pose risks of unauthorized access or breaches. For government agencies, this is a dealbreaker.

Why ScanWriter AI Stands Out

On-Premise Solution: Unlike cloud-based tools, ScanWriter AI ensures your data stays within your system. There’s no risk of it being exposed to external servers.

Government-Grade Security: ScanWriter complies with strict security standards, giving agencies full control over their data.

2. Scalability

Insurance fraud investigations can range from small, single-claim cases to large-scale schemes involving thousands of transactions.

Your software needs to scale effortlessly with the size and complexity of your investigations.

What to Look For

Can the tool handle large datasets without slowing down?

Does it perform well when analyzing multiple claims or linked cases?

How ScanWriter AI Helps

Processes thousands of claims in minutes, no matter the volume.

Handles data from diverse sources, including PDFs, invoices, and digital records, ensuring investigators don’t miss a single detail.

3. AI and Analytics

Fraudsters don’t make their activities obvious. Detecting fraud requires advanced tools that can identify hidden patterns, anomalies, and links in claims data.

Key AI Features to Look For

Anomaly Detection: Flags duplicate claims, inflated charges, or unusual spending patterns.

Entity Relationship Mapping: Uncovers connections between individuals, accounts, and claims.

Predictive Analytics: Anticipates fraud before it happens, based on past patterns.

ScanWriter AI’s Edge

Uses AI-driven analytics to uncover hidden relationships, such as links between staged accidents or coordinated fraud rings.

Highlights red flags investigators might miss, saving time and improving accuracy.

4. Integration with Existing Systems

Government agencies already use case management platforms, visualization tools, and reporting systems.

Your fraud investigation software should integrate seamlessly with these tools to avoid disruptions and improve workflows.

What to Check

Does it work with tools like Power BI or existing case management systems?

Can it streamline your current investigative process?

ScanWriter AI’s Seamless Integration

Easily integrates with tools like Power BI for data visualization.

Works within your existing system, so you can enhance your processes without starting from scratch.

5. Ease of Reporting

Investigators don’t just need to uncover fraud—they need to present findings clearly and convincingly. Poorly formatted or incomplete reports can weaken a case and slow down enforcement actions.

What to Look For

Can the tool generate detailed, professional reports?

Does it support visualizations like graphs and charts for better communication?

ScanWriter AI Delivers

Produces clean, structured data and customizable reports.

Integrates with visualization tools to help you create clear, professional presentations for stakeholders, legal teams, or court cases.

Conclusion

Insurance fraud investigations are no easy task. From spotting duplicate claims to unraveling organized schemes, the work is detailed and demanding.

Investigators need tools that can handle the complexity, reduce manual effort, and deliver results fast.

The right software makes all the difference. Tools like ScanWriter AI empower investigators to process data in minutes, detect hidden patterns, and maintain full control over sensitive information with its on-premise design.

It’s not just about saving time—it’s about uncovering the truth and building stronger cases.

As fraudsters become more advanced, agencies need smarter, more secure solutions.

Choosing the right software ensures investigators aren’t overwhelmed by data or slowed down by outdated processes.

ScanWriter AI is ready to help agencies meet these challenges head-on and stay ahead of the game.

Take the next step. Request a demo today to see how the right technology can transform your fraud investigations.

Disclaimer

This article is based on publicly available information about the tools mentioned. If you believe any details need updates, please get in touch, and we’ll revise the content promptly.